0

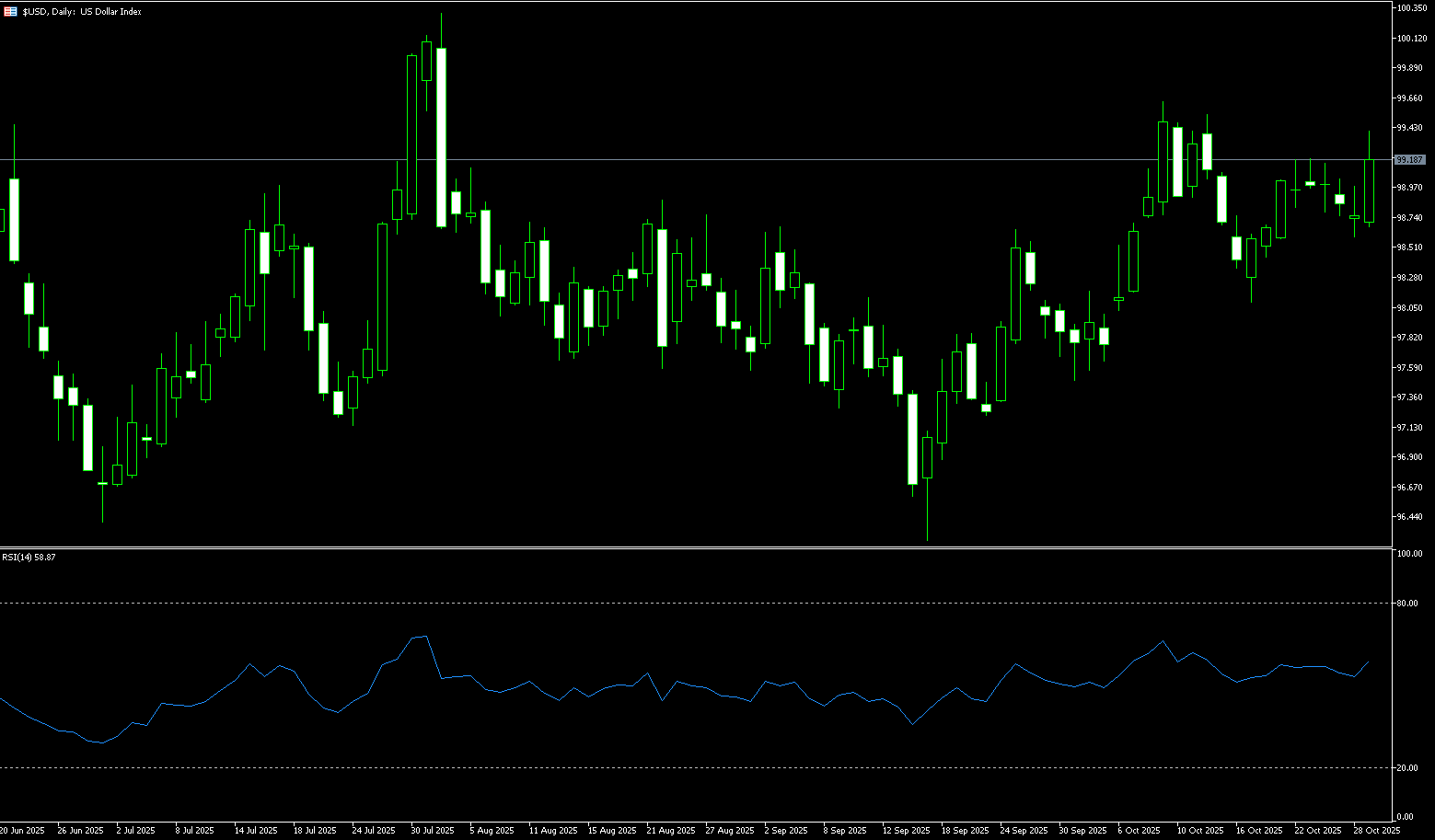

US Dollar Index

The US dollar index extended its gains to above 99.20 on Wednesday, its highest level since mid-October, after the Federal Reserve cut interest rates by 25 basis points as expected, although Chairman Powell stated at his regular press conference that a December rate cut was not a certainty. The market's implied probability of such a move fell to about 88%, down from about 90% earlier in the day. Investors generally expect another 25 basis point rate cut in December, consistent with the Fed's September forecast. Furthermore, at today's meeting, two officials disagreed: the governor of Milan supported a deeper half-percentage-point rate cut, while Kansas City Fed President Jeff Schmid advocated for maintaining stable interest rates. Meanwhile, investors anticipate a meeting between US President Trump and Chinese President Xi Jinping, which is expected to finalize a framework for suspending higher US tariffs and China's rare earth export controls. The dollar strengthened mainly against the pound, euro, Swiss franc, and yen.

From a technical perspective, the US dollar index has been under pressure recently, continuing its four-day pullback from the October 22 high of 99.14, falling to 98.57. Yesterday, the dollar index rebounded and broke through the 99.00 level. Traders are watching the 89-day simple moving average at 98.10 and the 98.00 level. Currently, as long as the dollar index remains above the 89-day simple moving average and the 98.00 level, the trend remains intact, and there is a chance to reclaim the 99.00 level and the 89-day simple moving average, with the next level being a potential recovery of the monthly high of 99.56. Otherwise, the market will continue its weak upward trend. Without new hawkish signals from the Federal Reserve, this situation is unlikely to change, so the downside targets are the 89-day simple moving average at 98.10 and the 98.00 level. Currently, this possibility seems quite high.

Today, consider shorting the US Dollar Index at 99.26, with a stop-loss at 99.38 and targets at 98.80 and 98.70.

WTI Crude Oil

US crude oil is trading slightly above $60.00 per barrel. Oil prices fell more than 2% on Tuesday as investors assessed the impact of US sanctions on Russia's two major oil companies on global supply, and OPEC+'s potential production increase in December. Last week, both Brent and US crude futures recorded their biggest weekly gains since June, as US President Trump imposed sanctions on Russia for the first time in his second term over the Ukraine crisis, targeting Lukoil and Rosneft. On the other hand, OPEC and its allies, including Russia, are inclined to increase production slightly again in December. The organization has previously limited production for several years to support the oil market and began gradually lifting production cuts in April this year. Increased OPEC+ production could help offset the reduction in Russian crude oil supply caused by US sanctions.

WTI crude oil prices were under pressure in the first half of the week, continuing a four-day correction from the high of $62.38 in late last week, falling to the psychological level of $60.00. WTI crude oil even broke below $60.00 to a near one-week low of $59.61. The 14-day Relative Strength Index (RSI) on the daily chart is near 50.00, leaving room for further declines. The nearest support levels are $59.22 (the 10-day simple moving average) and $59.00 (the psychological level). A break below these levels would target $57.31 (the low of October 22). The first resistance level is $61.16, the 34-day simple moving average. There is a possibility of further upward movement towards last week's high of $62.38. This rebound may pave the way for further upward movement in oil prices, given the shakeout in the shale oil industry and layoffs in the oil sector, making it difficult to increase production capacity in the future.

Today, consider going long on crude oil at 60.05. Stop loss: 59.88. Target: 61.70, 61.90

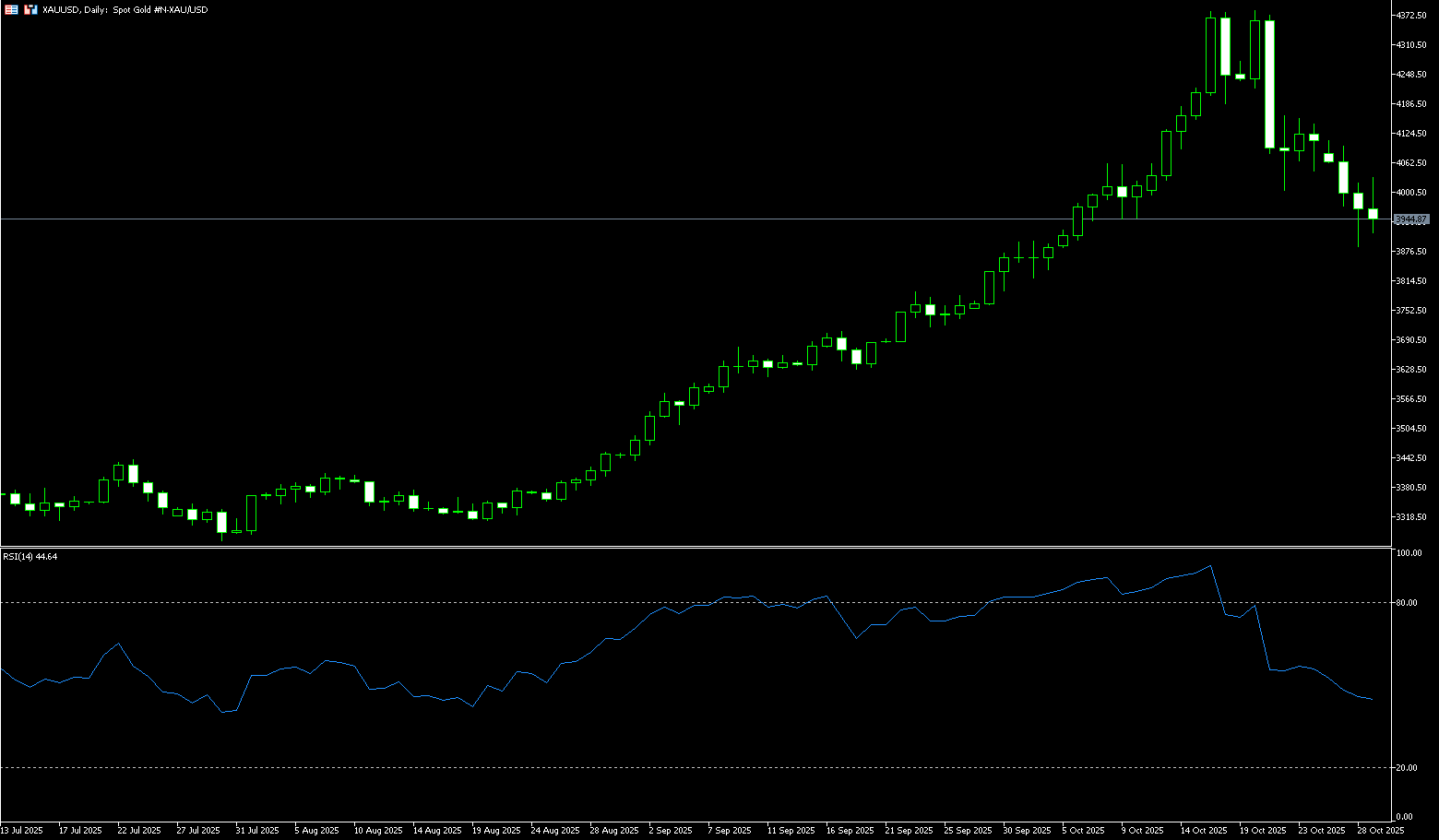

Spot Gold

On Wednesday, spot gold remained trading near $4,000 per ounce. Gold prices fell to a three-week low on Tuesday as hopes for progress in trade negotiations diminished gold's safe-haven appeal, while investors turned their attention to the Federal Reserve's interest rate decision this week. Gold, a traditional hedge against uncertainty and a non-yielding asset, has risen more than 51% this year, supported by geopolitical and trade tensions and expectations of a US interest rate cut. The London Bullion Market Association (LBMA) predicted at its annual meeting that gold prices would rise to $4,980 per ounce over the next 12 months, while Citigroup and Capital Economics both lowered their gold price forecasts on Monday. On the other hand, global market sentiment shifted towards risk appetite, with investors selling gold and turning to stocks and technology stocks. Meanwhile, Trump signed an agreement in Tokyo to strengthen the supply of key minerals. While these geoeconomic games haven't directly targeted gold, they've indirectly reinforced the narrative of a "risk asset" recovery, dimming gold's safe-haven appeal.

The outlook for gold isn't entirely pessimistic; the market is divided. Optimists, represented by the London Bullion Market Association (LBMA), boldly predicted at their annual meeting that gold prices would surge to $4,980 per ounce in the next 12 months, supported by continued escalating geopolitical risks and a global central bank gold-buying spree. Overall, gold prices may continue to face pressure in the short term, with the first support level at the psychological level of $3,900, while Tuesday's low of $3,886 may not be the bottom. The next level to watch is $3.842 (the 45-day simple moving average), with the ultimate target at the psychological level of $3,800. However, in the medium to long term, if the Fed's rate-cutting cycle deepens or geopolitical events reignite, gold still has the potential to regain its upward momentum. In the short term, watch for resistance near the psychological level of $4,000. Then there's the $4,074 level (20-day simple moving average). A break above that level would target $4,100 (psychological level).

Consider going long on gold today at $3,925, with a stop-loss at $3,920 and targets at $3,980 and $3,970.

AUD/USD

The Australian dollar rose slightly to around $0.6607 on Wednesday, its highest level in three weeks, as investors sharply reduced their bets on a rate cut next week after inflation data came in higher than expected. Australia's monthly consumer price index for September 2025 rose 3.5% year-on-year, up from 3% in August and also exceeding the expected 3.1%, marking the highest level since July 2024. The rise was mainly driven by increased housing and transport costs, keeping inflation above the Reserve Bank of Australia's 2-3% target range. Core inflation also exceeded expectations, with the trimmed average consumer price index rising 1% from the previous quarter and 3% year-on-year, the first increase since December 2022. The latest data reinforced the view that price pressures persist, despite signs of a cooling labor market prompting investors to significantly reduce their bets on further easing.

The Australian dollar traded slightly below 0.6600 against the US dollar on Wednesday, after earlier touching 0.6607, its highest level in three weeks. Technical analysis on the daily chart suggests a bullish shift as the pair broke out of its descending channel. The pair is also trading above the 5-day and 50-day simple moving averages (0.6553 and 0.6558), indicating that short- and medium-term price momentum remains strong. On the upside, immediate resistance lies at the psychological level of 0.6600-0.6607 (the triple high). A break above this level would support the pair's exploration of the September 18 high of 0.6660 and further challenge the area near the 12-month high of 0.6707. Key support is at the 50-day simple moving average at 0.6558, coinciding with the 5-day simple moving average at 0.6553. A break below these levels would resume the bearish bias and cause the Australian dollar to hover around 0.6500 against the US dollar.

Consider going long on the Australian dollar today at 0.6562, with a stop loss at 0.6550 and targets at 0.6630 and 0.6620.

GBP/USD

The pound/dollar pair fell for the second consecutive trading day, trading around 1.3200 in European time on Wednesday. The pound weakened as data from the British Retail Consortium (BRC) showed UK food prices falling at their fastest pace in nearly five years, reinforcing expectations of an imminent interest rate cut by the Bank of England. Traders now see a roughly 68% chance of a 25 basis point rate cut by the Bank of England in December, as slowing inflation and fiscal headwinds provide the central bank with more room for easing. Expectations of a rate cut also strengthened after reports that the Office for Budget Responsibility planned to lower its UK productivity growth forecast by about 0.3 percentage points, a reduction that could widen the fiscal deficit by nearly £20 billion. This revision has exacerbated concerns about Chancellor Rachel Reeves' November budget, which is expected to address a potential shortfall of up to £35 billion.

The daily chart shows that GBP/USD has shown signs of weakness in recent weeks. From a momentum perspective, sellers have the upper hand, with the Relative Strength Index (RSI) turning bearish on the afternoon of the 14th, continuing its decline to the 35.85 level. The pair is currently slightly below the 200-day simple moving average at 1.3241. A break below the 200-day moving average could pave the way for a further test of the 1.3200 psychological level. The next target would then be 1.3141 (the low of August 1st). Conversely, if GBP/USD recovers above 1.3300, buyers would need to push the spot price above the 20-day simple moving average at 1.3371. Further upside targets are above 1.3400.

Today, consider going long on GBP at 1.3185, with a stop-loss at 1.3173 and targets at 1.3240 and 1.3250.

USD/JPY

On Wednesday, the yen traded near the 152.50 level against the dollar as investors prepared for the Bank of Japan's policy decision this week, expecting interest rates to remain unchanged. However, policymakers will discuss the conditions for resuming rate hikes as tariff-related risks have eased, although persistent inflation continues to weigh on the outlook. On Tuesday, US Treasury Secretary Scott Bessenter met with Japanese Finance Minister Satsuki Katayama to discuss currency volatility, urging a "prudent monetary policy," seen as a criticism of Japan's slow interest rate normalization. Japan's Minister for Economic Revitalization also stated that the government is closely monitoring the yen's weakness, while noting that a weaker currency still benefits exporters. Meanwhile, US President Donald Trump met with newly appointed Japanese Prime Minister Sanae Takaichi on Tuesday, pledging to strengthen US-Japan relations and signing agreements on trade and key minerals.

Early this week, USD/JPY encountered resistance near the 153.25-153.30 level, or the monthly high, forming a bearish "double top" pattern on the daily chart, supporting the view that the pair will depreciate further. Nevertheless, the oscillators on the chart remain in positive territory, suggesting that any further declines may find some support around 151.36 (the 20-day simple moving average). However, a decisive break below the latter should pave the way for a deeper drop towards the psychological level of 150.00, with some intermediate support around 150.47 (the October 21 low). On the other hand, any significant rally above the Asian session high (around the 152.20 area) is more likely to attract new selling and be capped near the 152.90-153.00 area. Some follow-through buying, leading to a stronger break above the 153.25-153.30 area, would be considered a new breakout and would allow the USD/JPY pair to reclaim the 154.00 level.

Today, consider shorting the US dollar at 153.00. Stop loss: 153.20. Target: 152.00, 151.80

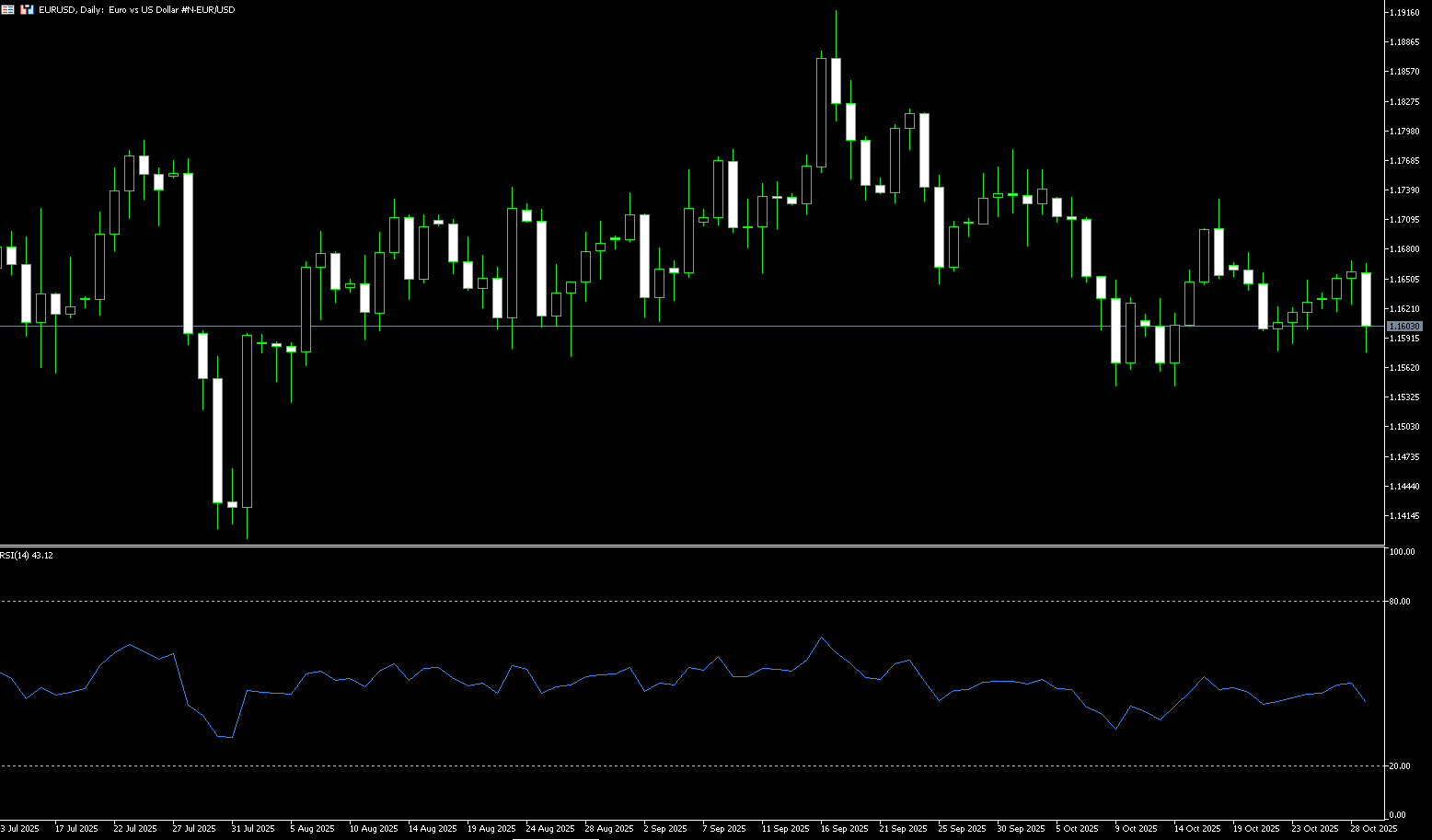

EUR/USD

During Wednesday's American trading session, the EUR/USD pair fell to near 1.1600. Optimism surrounding the US-China trade agreement put pressure on riskier currencies such as the euro, especially against the dollar. Traders are awaiting the European Central Bank's monetary policy meeting. Positive progress in the US-China trade negotiations could boost the dollar and put pressure on major currency pairs. On the other hand, across the Atlantic, the European Central Bank is expected to keep interest rates unchanged on Thursday, marking the third consecutive meeting without adjusting the key deposit rate. ECB President Christine Lagarde stated that current monetary policy is "in good shape" and will adopt a data-driven approach without pre-committing to a future interest rate path.

The euro continued its rebound against the dollar, retreating after rising for the fifth consecutive trading day, climbing from a low of 1.1576 last week to a high of 1.1668 before giving back to around 1.160. The euro continued its appreciation, briefly breaking through 1.1650 to reach a one-week high. Although the upward momentum remains fragile, facing resistance at the 1.1700 (psychological level) and 1.1728 (October 17 high), signs of easing in US-China trade relations and market expectations of further interest rate cuts have boosted risk appetite, putting pressure on the safe-haven dollar and supporting the euro, which is testing the 1.1778 (October 1 high) level. On the other hand, the 14-day Relative Strength Index (RSI) is near 50.00, leaving room for further declines. Below, support is near the 1.1600 level, followed by last week's low of 1.1576 and the 1.1573 (134-day simple moving average) area. A break below these levels would target the 1.1500 (psychological level).

Today, consider going long on the Euro at 1.1590, with a stop-loss at 1.1578 and targets at 1.1640 and 1.1650.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Lebih Liputan

Pendedahan Risiko:Instrumen derivatif diniagakan di luar bursa dengan margin, yang bermakna ia membawa tahap risiko yang tinggi dan terdapat kemungkinan anda boleh kehilangan seluruh pelaburan anda. Produk-produk ini tidak sesuai untuk semua pelabur. Pastikan anda memahami sepenuhnya risiko dan pertimbangkan dengan teliti keadaan kewangan dan pengalaman dagangan anda sebelum berdagang. Cari nasihat kewangan bebas jika perlu sebelum membuka akaun dengan BCR.

BCR Co Pty Ltd (No. Syarikat 1975046) ialah syarikat yang diperbadankan di bawah undang-undang British Virgin Islands, dengan pejabat berdaftar di Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands, dan dilesenkan serta dikawal selia oleh Suruhanjaya Perkhidmatan Kewangan British Virgin Islands di bawah Lesen No. SIBA/L/19/1122.

Open Bridge Limited (No. Syarikat 16701394) ialah syarikat yang diperbadankan di bawah Akta Syarikat 2006 dan berdaftar di England dan Wales, dengan alamat berdaftar di Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX. Entiti ini bertindak semata-mata sebagai pemproses pembayaran dan tidak menyediakan sebarang perkhidmatan perdagangan atau pelaburan.